The last few years have witnessed India as one of the most hot and lively markets in the world for start-ups. The initiative of the government, Startup India, intends to encourage entrepreneurship through innovation and jobs with intensity all over the country. The famous city of Delhi can become the starting point for entrepreneurs who will unlock several benefits of financial and legal administrations.

This becomes crucial if you’re planning to start a business in Delhi, because then, understanding the process of registration under Startup India is extremely important. So, your startup could qualify for government support, tax incentives, and so on.

This all-inclusive guide will help you understand what Startup India is about, its whole procedure of registration in Delhi, its benefits, and who should get it, along with the documents required. And then, through this piece, find out how you can register your startup and take up the many opportunities for upcoming entrepreneurs in Delhi.

The government starts Startup India Registration to make a company eligible as a startup and avails them of all benefits underneath the scheme of Startup India. This program designed by the Ministry of Commerce & Industry takes the initiative of ease of setting up and expanding entrepreneurship ventures.

This may involve tax exemption, relief from compliances, and scope for more options of funding. To register under Startup India, the companies have to meet certain criteria. The company is eligible for a series of advantages if it has created unique products and/or services and is less than 10 years old.

Once registered, all of these advantages may decrease the operational burden and encourage business development.

Register your startup under the Startup India program and avail yourself of all the widespread benefits. Some of the major benefits accrued to the startup through this are as follows:

Tax Exemptions and Benefits

- Income Tax Exemption: The three-year tax holiday in the first seven years of operations is available to the startup to avail of the conditions. This would reduce the tax burden and earn the business earnings that can be reinvested for growth.

- Exemption on Capital Gains: Tax On your startup venture, if it’s eligible, you may even be exempted from paying capital gains tax on the investments made into specific startup ventures.

Easier Compliance Requirements

The scheme of Startup India simplifies compliance by registered startups. There exists a self-certification mechanism for laws related to labor and environment that reduces the complication with regard to regulatory requirements.

Access to Funding and Incubators

The fund offers easier access to financing through government-backed schemes and a network of investors. It offers an application opportunity through the Fund of Funds managed by SIDBI to the Startups.

Intellectual Property (IP) Benefits

The initiative serves easy and low-cost ways of filing patents and trademarks, thereby making innovations safe. This is essential for startups, especially in a competitive market, to ensure all ideas and intellectual property are protected.

Networking Opportunities

Being an entity registered under Startup India, your business will find a place within the startup ecosystem through which you get to network with other entrepreneurs, investors, and other potential partners.

Government Tenders

The entity can directly apply for government tenders, which is a major advantage considering the scale and frequency of government procurement.

A Startup India registration will be offered to entrepreneurs who possess the following qualifications:

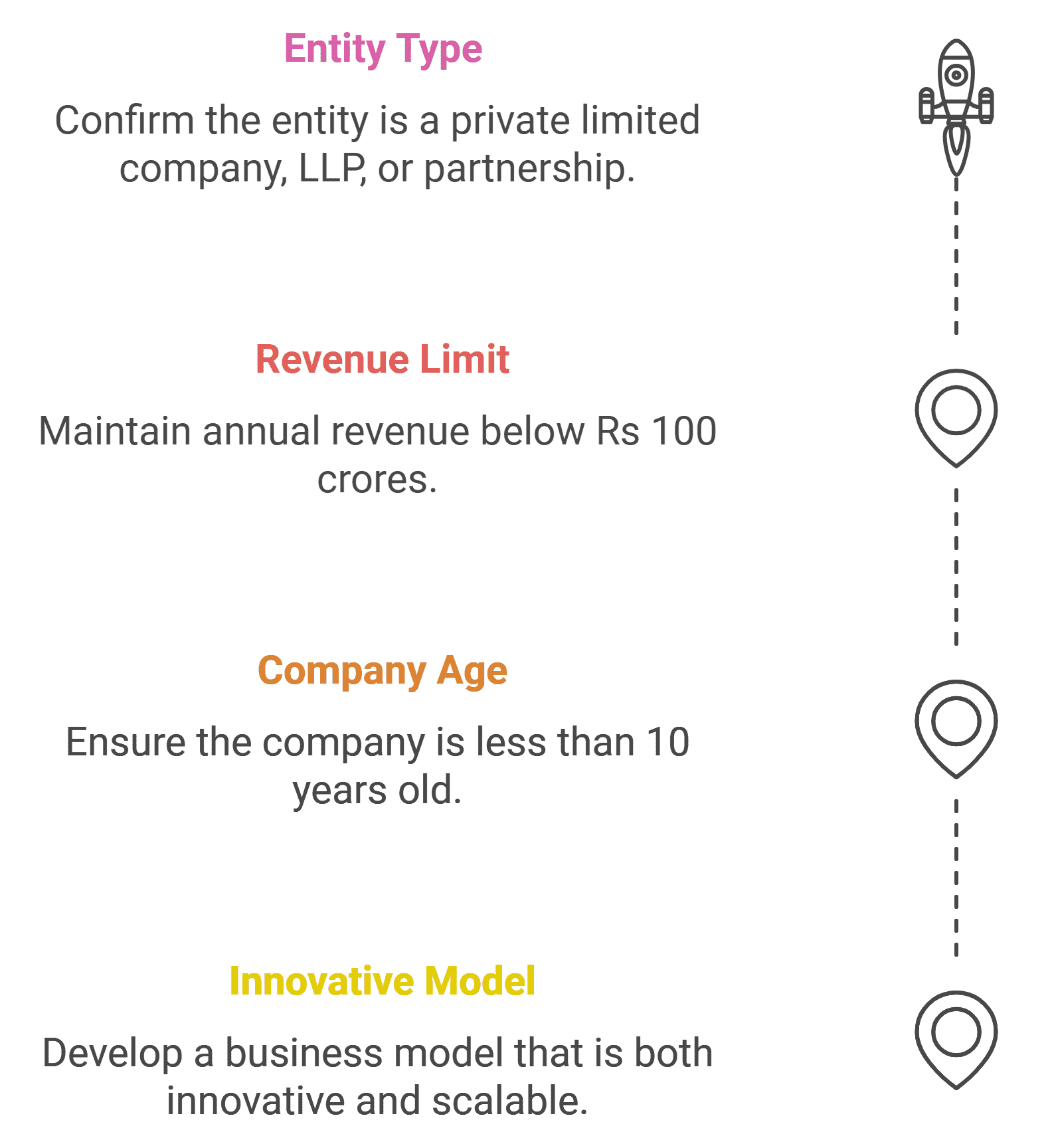

- Innovative and Scalable Business Model: They should have innovative business models in terms of innovative products, services, or processes. They should be scalable such that jobs can be created for people and can gainfully contribute to the economy quickly.

- Age of the Company: The company age is less than 10 years old at the date of incorporation concerning availing registration under the new Start-up India initiative.

- Annual Turnover Limit: The revenue of the startup should not have exceeded Rs 100 crores in any year since incorporation.

- Entity Type: The entity should be either a private limited company, LLP, or a partnership firm.

Among the documents required when filing for registration under Startup India in Delhi are the following to ensure smooth registration:

- It is the registration document proving that your startup has been registered in the records of the Ministry of Corporate Affairs, MCA.

- There should be a leasing agreement or any other document of ownership of property in the name of the business or owner to authenticate the location of the startup.

- Copy of the company’s PAN card as statutorily required for all Indian firms.

- MoA contains the parts of the aims of the firm and the Shareholders’ Agreement reflects the rights and duties imposed upon the shareholders.

- A bank account is to be opened in the name of the business entity to carry out financial transactions that will be required at the time of registration.

- A short document providing an overview of your business idea, products, services, and projections for the future, which helps to expose your startup’s growth potential.

- Proof of directors’ identity and that of authorized signatories, such as an Aadhar card, passport, or voter ID.

The procedure for registration under the Startup India scheme is quite straightforward. This guide will help you avoid all hitches in applying:

The process of registering a startup seems to be a complicated procedure, especially when it comes to legal and regulatory compliances and requirements. However, a legal Expert is here for you. Being one of the best Legal solutions in Delhi, Legals Expert offers end-to-end services related to Startup India Registration.

That’s why you should turn to Legals Expert for your startup registration:

- Expert Legal Advice: Our lawyers assist you through each stage of the registration procedure. Ensuring all your documents are correct while meeting at the same time all the necessary conditions.

- Quick and Efficient Process: We specialize in registering startups, ensuring that your registration process is as smooth and hassle-free as possible. Thereby giving you much-needed time to focus on building your business.

- Comprehensive Startup Services: We provide company incorporation, IP registration, and tax filing, all tailored according to your specific business needs, government approvals, and much more.

- Affordable Packages: Legals Expert provides you with affordable solutions for your startup. We want to make sure you get the maximum out of the money spent on it.

- Post-Registration Support: We keep supporting you even after registering your startup. For instance, on matters of compliance, tax filings, and many more related legal aspects, we are here to help you.

Ans: Registration time usually takes 7-10 business days after the documents are deemed complete.

Ans: No. Registration will open only to such businesses that qualify to be less than 10 years old, innovative, and with an annual turnover of up to INR 100 crores.

Once your startup is registered under the Startup India scheme. You are free to file for income tax exemptions through the Income Tax Department along with the necessary documents.

Ans: It’s not obligatory to register under the Startup India scheme, but registering under this will open up several benefits that would help your startup grow and succeed.

Ans: In case your startup no longer satisfies the eligibility criteria. Your recognition under this scheme of Startup India will be withdrawn, and you will lose the benefits enjoyed.